Why is it essential to teach investment principles to kids?

When it comes to investing, time is our greatest ally. The more time we give our investments to grow, the larger they are likely to become. The trouble is that most people aren’t taught the concept of investing until they’re much older. If kids haven’t taken any specialised courses on financial literacy in school, they might not understand it until adulthood.

Just imagine how much wealthier you’d be if you’d only started investing when you got your first after-school job as a teen instead of waiting for adulthood. In a recent survey from financial services firm D.A. Davidson, one-third of respondents said children should start learning about financial literacy at age ten or younger.

Here’s how you can get young people off to a great start financially by teaching them vital lessons about money.

Start with basics

Start by just talking about money whenever it’s relevant during your day-to-day lives. If you have some money in your pocket, let them group the bills and coins and count. If you’re shopping with your children, you might discuss how you’re looking for items on sale or comparison shopping to save money.

You can have them watch you pay bills and learn how much it costs to have electricity, heat, or a cell phone. If you’re in debt and are paying it off, show them how that’s going, and share any lessons you’ve learned, such as how dangerous and regrettable it is to rack up lots of debt on costly credit cards. Teach early money management by giving them an allowance and encouraging them to earn some money by doing chores or taking on small jobs, such as babysitting or washing dishes.

Save, then invest

One great idea is to have them divide their money into three, spending a third on whatever they want, saving a third, and giving away a third. You can do this through the classic “give, save, spend” jars. These work because they teach delayed gratification through visual means.

Later on, you can add investing by adding a “grow” jar. If a kid puts $100 into an investment jar and then receives $101 after some weeks, they will start to understand that they earned money by simply not touching their money. The goal isn’t to make huge gains, it’s to teach the concept of invest, wait, earn.

When they have a grip on this concept, you can also break down the different types of bank accounts, the meaning of loans, and the difference between renting and mortgages. Later, you can add how interest is calculated with percentages, what stocks and bonds are and the difference between risk and reward.

Compounding

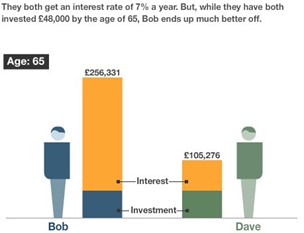

Another popular technique is through infographics. As you’ll want them to become lifelong investors, be sure to discuss the power of investing, such as in the stock market, where money has grown at an average annual rate of 10 percent or more over long periods. To help them appreciate how powerfully money can grow via compounding, show them the chart below of two people who start investing the same amount at different times.

The chart shows how they can amass hundreds of thousands of pounds, if not millions, just by being diligent and patient. Point out how important time is and how fortunate they are to be very young because any money they invest will have a long time to grow.

Explain stocks

Introduce them to stock market by explaining the actual stocks in existing companies. Explain that if you own a few shares of Netflix, for example, you are a part-owner in the company.

Practice theoretically

If you aren’t ready to teach your kids to invest using real money, you could make a game out of it. Stock market simulators like Wall Street Survivor and How The Market Works let you invest an imaginary portfolio of funds. You could have every member of the family create their own portfolio and make it a competition. Then you can talk about why certain stocks performed well while others flopped.

Let them practice in the real-world

You can even get your kids investing for real — perhaps by setting up a custodial brokerage account. They’ll likely lose some money, at least over the short term, so be sure to help them understand that not all investments work out and that patience is required. Also, the more they learn about investing and how to assess the quality and price of a company and its stock, the better they can do. Remind them about the chart above and how growing savings can give them financial security for life and help them reach their goals and dreams.

Advanced financial education

When the above activities start making sense, you can support your child’s financial education by giving them better resources. Here are some of our recommendations:

Investing for Kids, Dylin Redling and Allison Tom (for 8–12-year-olds)

Growing Money: A Complete Investing Guide for Kids, Gail Karlitz (for 8–12-year-olds)

The Young Investor, Katherine R. Bateman (for 9+-year-olds)

Millionaire bootcamps for kids

Besides books, innovative activities like camps to teach kids how to become millionaires have also sprung up across the globe. In Denver, there’s Junior Money Matters, which teaches international trade theory to pre-teens. While Kids Biz Academy in Hong Kong runs a holiday camp where kids ages 8-14 learn the nuts and bolts of running a business, from product design venture capitalism. And Youngpreneurs, based in Kolkata, India, pairs teenagers with real-life entrepreneurial mentors.

In Canada, Camp Millionaire teaches budgeting, saving and making investment decisions, as well as more complex financial concepts like how a trade war with China might affect a Canadian investor’s bottom line. According to Hasina Lookman, a project manager who founded and teaches at Camp Millionaire, it’s the youngest kids who “really get into the stock market challenge”.

It’s important to allow your child to make real decisions and take real risks. These exercises will familiarise them with investing, and part of that is learning that investments have advantages and disadvantages. Whatever the outcome, the experience of following their investments and gaining and losing money—whether actual or theoretical—will be invaluable.